The Words We Use In Bitcoin

Words, Language, Terminology, and Linguistic Attacks

2 conversations 9 translations 🧡It can’t be said often enough: Bitcoin is confusing. However, it’s not complicated like a Rube Goldberg machine is complicated. It’s just very foreign and thus very misunderstood—it is a completely new thing. “There’s nothing to relate it to,” as Satoshi put it in one of his posts.

Because there is nothing to relate it to, we are all having a hard time wrapping our heads around the various aspects of it. We need to use words if we want to talk about it in a meaningful way, and words are what I will focus on.

I want to talk about two things: (1) the language used in Bitcoin and (2) the language used to attack bitcoin.

Part 1: The Language Used In Bitcoin

Let’s get one thing out of the way: it’s all numbers, all the way down. Bitcoin does the one thing that all computers do, which is actually two things: it takes certain numbers as inputs, does calculations, and presents the result of said calculations to someone else. In Bitcoin’s case, this “someone else” is another node on the network—or multiple, to be precise. When stripped down to its bare essentials, that’s all there is to it: math and messages.

Consequently, we have to use metaphors—and lots of them. Keys, wallets, addresses, signatures, contracts, mining, dust, fork, oracle, orphan, seed, witness—the list goes on.

However, here’s the thing with metaphors: “All metaphors are wrong, but some are useful,” to paraphrase George Box. Undoubtedly, many people are confused precisely because of the shortcomings of these metaphors. All the labels that we apply to the various concepts in Bitcoin are wrong, at least a little bit. Some are wrong a lot. Everyone who ever tried to explain that “your bitcoins are not actually in your bitcoin wallet” to a glossy-eyed newbie knows what kind of confusion I’m talking about.

Unfortunately, this confusion won’t be going away anytime soon. And more worryingly, this confusion is being weaponized by legislators, politicians, and commentators alike. Those who despise Bitcoin are trying to pass laws and plant ideas in people’s heads that are bastardizing how Bitcoin works, as well as the language we use to describe how it works. Consequently, it would be beneficial to get our language straight. After all, how high are the chances of understanding something deeply if the words we use to describe said thing are inadequate?

First, let’s go through some of the words we use in Bitcoin and see where they fall short. We all know these words, and we usually don’t think twice about them. Let’s start with “wallet.”

“Wallet”

A wallet is a piece of software or hardware that makes it easier or more secure to store and/or spend your bitcoin. It’s easy to see that a wallet is neither one thing nor easily defined; just look at all the various forms of wallets we came up with over the years: paper wallet, brain wallet, hardware wallet, mobile wallet, multisig wallet, lightning wallet, watch-only wallet, and so on.

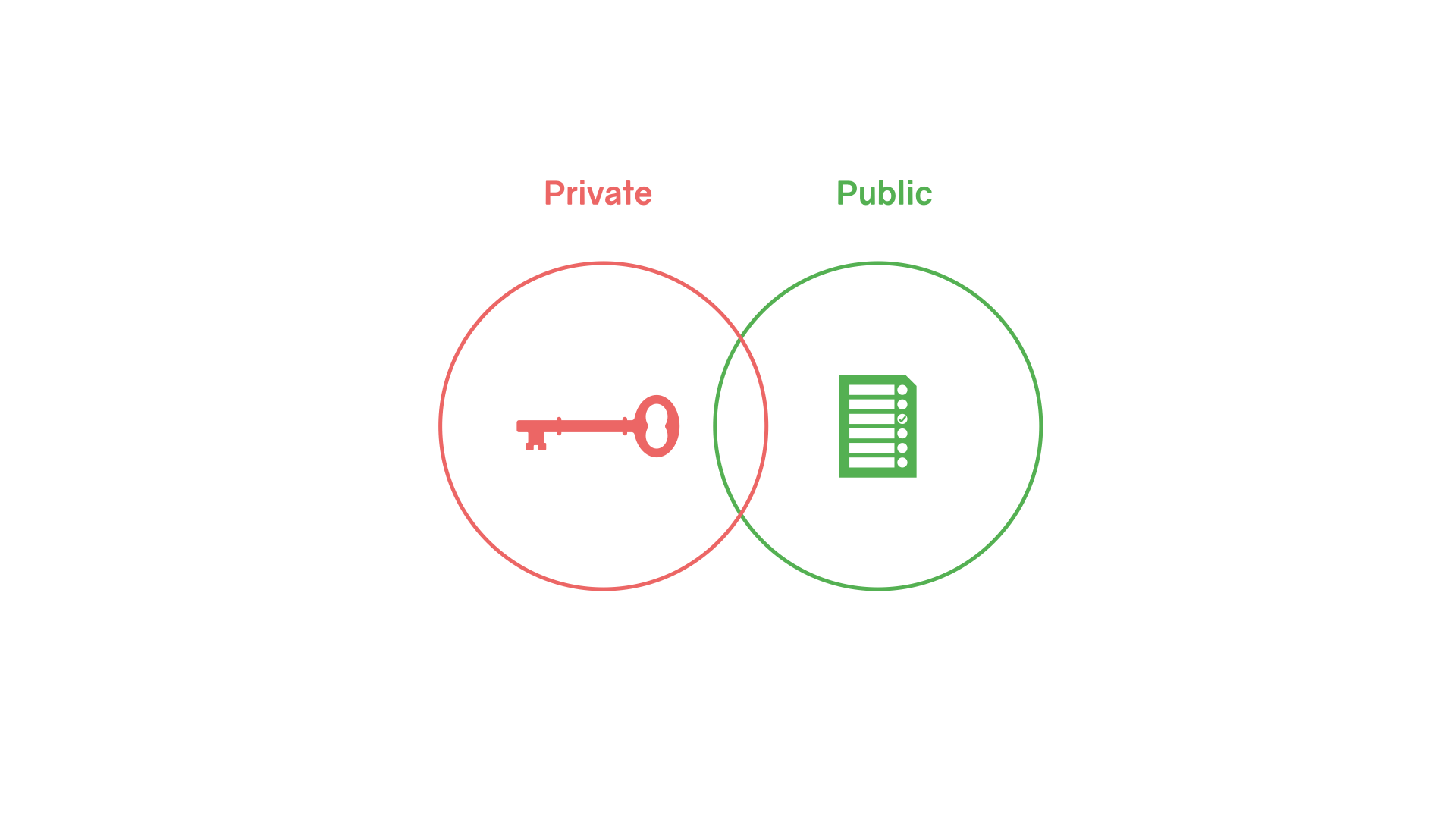

In the end, we have to understand how Bitcoin operates if we want to get a grip on what a wallet is. Here is the gist of it: to create a bitcoin transaction, you need to sign a message with a private key. Consequently, two things are essential for a wallet: key storage and signing. But that’s not enough, usually. To interact with the Bitcoin network, you need to interact with a Bitcoin node. You need a way to access the public information, the “distributed ledger” that is so often mentioned by finance and crypto bros alike.

What we have historically called a bitcoin wallet, thus, is just some software that manages and stores keys and allows the user to easily use these keys to sign and broadcast messages. To increase security, said software might be embedded in a dedicated hardware device. The more effort it is to spend your sats, the lower the risk of theft or loss of funds. A wallet might not have any signing capability at all, as is the case for brain, paper, or watch-only wallets. This begs the question: how useful is the term wallet?

Interestingly, we have already switched to a different term when it comes to seed storage. We are not talking about “metal wallets” or “metal keys” when we talk about key storage; we usually talk about seed storage, metal seeds, or seed plates nowadays.

Further, we now refer to various multi-signature and timelock constructs as “vaults”—a powerful and clear distinction. The vault metaphor makes it immediately obvious that whatever is stored in the vault is there for the long haul. It isn’t spendable easily or quickly.

I hope that, in the future, we will also manage to do away with the generic “wallet” term. When it comes to hardware wallets, a change of terms is already underway. Given that a hardware wallet is nothing but a small device that is used for signing transactions, a more accurate term is “signing device,” which is currently gaining traction thanks to people who understand the technicalities of Bitcoin deeply.

Maybe usage will morph so that whenever someone says “wallet,” it is implied that it is something that isn’t holding massive amounts of value and that said value is spent easily and quickly, as is the case for Lightning wallets. In the end, the “wallet” metaphor will always be wrong in a crucial way: your wallet does not actually hold any of your coins. That’s not how Bitcoin works. It might hold your keys, which brings us to the next word.

“Key”

In the physical world, a key is used to open something. A door, a chest, a locker, and so on. It might also be used to start something: a car, a motorbike, a nuclear missile—you get the idea.

As mentioned before, to create a bitcoin transaction, you use your private key to sign a message. The keys in bitcoin are cryptographic keys, and cryptographic keys can be used to create digital signatures.

This, of course, only makes sense in the world of cryptography. Commonly, a key is used to lock and unlock things. If you want to sign something, you need a pen. This confusing metaphor is not exclusive to Bitcoin, of course. Plenty of other software uses cryptographic keys to sign stuff, which is why in 2010, this abomination of an emoji was introduced: the padlock, “locked with pen.”

Consequently, a “key” in bitcoin is more like a pen, not an actual key. Granted, you can use your key to “unlock” sats that are “locked” by yourself or someone else, but still, no matter what metaphor you use, it will always fall short. It will always fall short because the keys in Bitcoin are data, nothing else. Your private keys are secret information—information that nobody but you should ever know. If someone else gets possession of your private keys, your bitcoin will be their bitcoin.

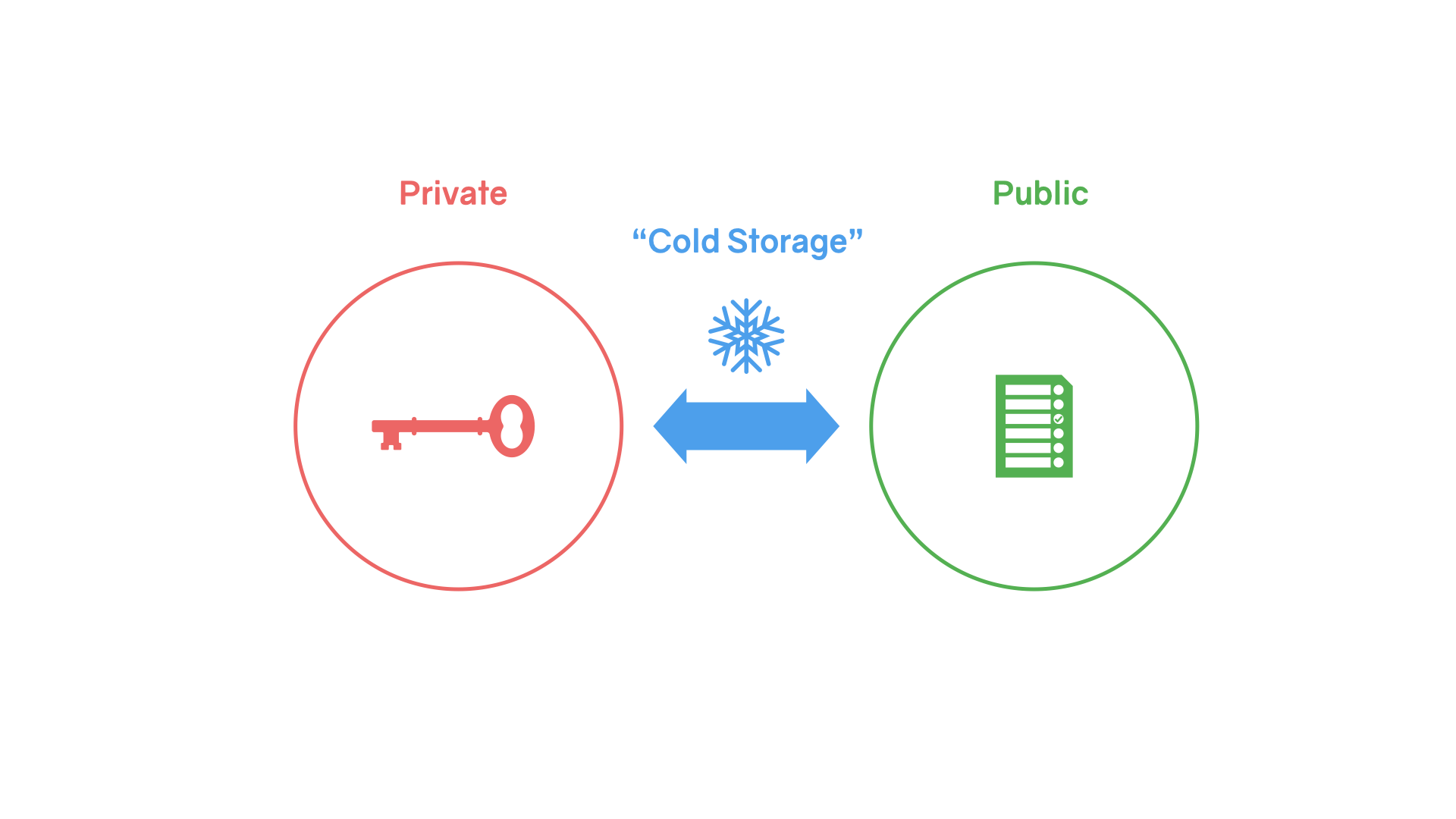

To make theft or accidental spending as difficult as possible, keys that give access to large funds are held in “cold” storage. The secret information is disconnected from the internet, held on special signing devices that never touch a general computation device.

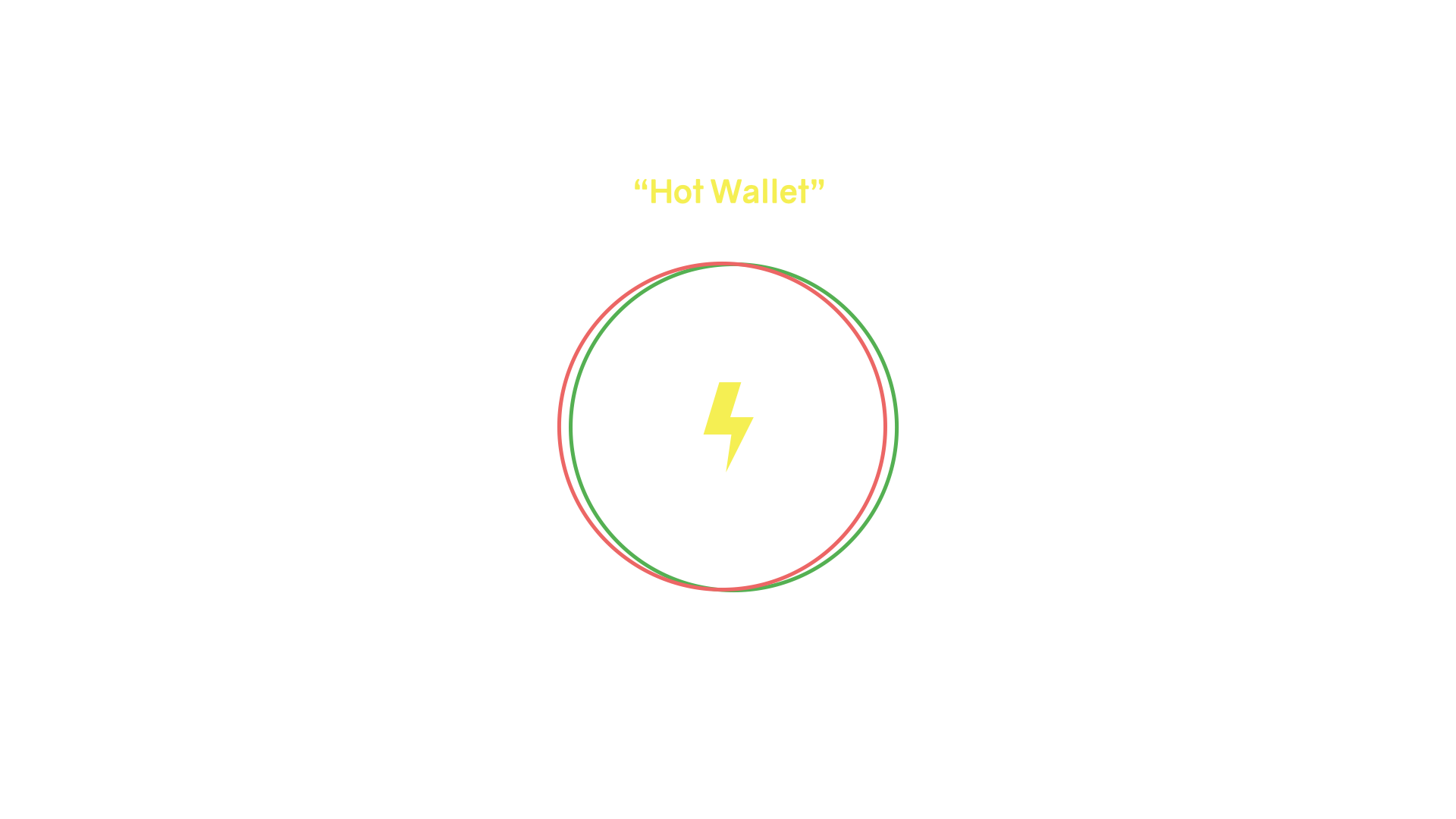

A “hot wallet,” on the other hand, brings the secret information required to move your sats as close to the network as possible. If you want to spend frequently, your keys have to be readily available. A lightning wallet, for example, is a “hot” wallet: the private keys that allow you to spend your sats are connected to the internet at all times. If your computer or smartphone is compromised, your funds are at risk. Such are the tradeoffs between “hot” wallets and “cold” storage.

“Hot” and “cold” are again, of course, metaphors. A hot wallet is hot like a microphone in a recording studio is hot. It means that it’s charged, fired up, and to be handled with care, not that its temperature actually increased.

We can see that language is neither singular nor static, which makes the line between a useful metaphor and an outright linguistic attack a blurry one.

The “key” metaphor, for example, isn’t terribly wrong. We can actually think of signing as unlocking. The underlying elements responsible for spending sats are referred to as locking and unlocking scripts, and for good reason. These scripts are small computer programs that define the conditions that are required for certain sets of sats to move. You can think of it like this: those who want to move sats have to solve a cryptographic puzzle. Usually, a private key is required to fulfill the spending condition: the key is the key to the puzzle. So if we think “key to the puzzle,” it’s not even wrong. And anyway, I’m afraid we’re stuck with it.

Two more things: the reason why your private key can be represented as words is that it is, just like everything else in bitcoin, information. And the reason why we call these words a “seed phrase” is because your private key is the seed from which all your other keys and, ultimately, addresses are derived from. This brings us to the next word: “address.”

“Address”

This is probably the worst of all. To quote Luke Dashjr: “It’s so bad, we made a BIP to get rid of it.” He is talking about BIP 179, a Bitcoin improvement proposal that’s sole purpose is to propose a new term for “address.” The new term is “invoice,” which is the default in lightning and is actually more accurate—technically speaking—even on the base layer. It is more accurate because bitcoin transactions do not have a “from address,” even though you might think they do, especially if your mind is poisoned with the “address” metaphor.

The concept of a “from address” only exists heuristically. In Bitcoin, only receiving addresses exist. A transaction does not contain a from address. A transaction only contains the aforementioned scripts, which are challenges and solutions to challenges. If you can solve the challenge, you can move the coins.

The way to think about this properly is to think about flows, not coins. Let’s say you take a big scoop of water out of a lake, and let’s further say that this lake is fed by multiple streams. It’s a pristine lake in a mountainous region, so you fill up your bottle to cool yourself off with a refreshing drink. You sit down, take a sip, and ponder the following question: where did the water in your bottle come from?

From the lake, obviously—but from which stream? And how many molecules came from the clouds directly, raining down on the lake? Can you tell, even in principle? A God-like entity probably could, since water consists of molecules, and you could—at least in theory—track said molecules.

You can understand Bitcoin and bitcoin transactions in a similar way: transactions can have multiple inputs and multiple outputs, i.e., inflows and outflows, to stick with the liquid metaphor. However, there is one important difference: there are no molecules in bitcoin; there is only accounting. You can’t track anything for sure; you can only make educated guesses—heuristics that are, in many cases, plain wrong.

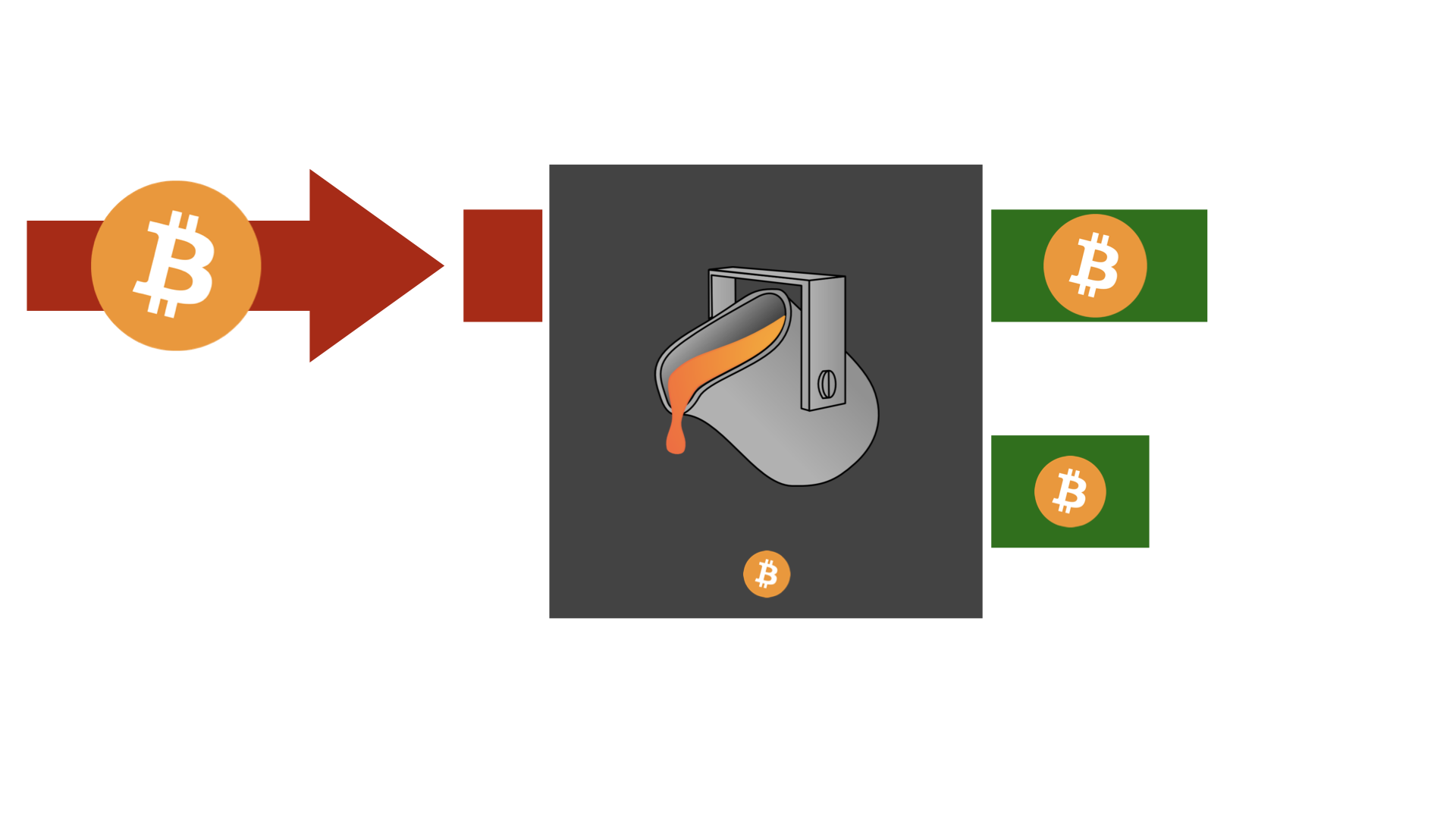

There are no molecules in bitcoin because every transaction “destroys” all inputs and creates new outputs. If you are dead-set on thinking about coins—i.e., if you view every UTXO as a coin of a different size—you can think about every transaction as a smelting process. All inputs are liquified in a big furnace, and new coins are created as outputs.

This brings us to the next problematic metaphor: coins.

“Coins”

I always loved this quote by Peter Van Valkenburgh, musing on the locality of bitcoin—or lack thereof:

Where is it, at this moment, in transit? […] First, there are no bitcoins. There just aren’t. They don’t exist. There are ledger entries in a ledger that’s shared […] They don’t exist in any physical location. The ledger exists in every physical location, essentially. Geography doesn’t make sense here — it is not going to help you figuring out your policy here.

What we call “coins” only exist by convention. The protocol is oblivious to our notion of coins. It only knows sats and spent or unspent transaction outputs. Spent outputs are inputs of past transactions. If the sum of one or multiple outputs adds up to 100 million sats, we call it “one bitcoin.”

Of course, it is way easier to talk about “coins” and “addresses” and “wallets,” because we know these things intimately from our real-world experience. We have an intuitive understanding of these metaphors, so it is clear what is happening if one “coin” moves from one “wallet” to another “wallet”—or so we think.

While the mental image of coins moving from one wallet to the next in an intuitive and easy-to-understand manner is a comforting one, nevertheless, it is wrong. What happens under the hood in bitcoin is much more wonderful, much more elegant, and much more magical than boomer gold coins moving from one leather purse to the next. It has to be. Bitcoin is information, not a physical thing. It is teleported at the speed of light, not moved in any physical sense. It is Magic Internet Money for a reason, and I’m afraid that we all have to understand its inner workings to a certain degree, especially if we want to be properly equipped to fight against any and all linguistic attacks, present and future.

Part 2: The Language Used To Attack Bitcoin

Bitcoin is under attack, always. Money is adversarial by nature because money is used between parties that aren’t fully trusting each other in the first place. Consequently, a monetary system is an adversarial system.

Everyone would love to have something for nothing; to cheat the system and get away with it. Everyone’s a scammer;1 everyone wants to get some sats for free.

Bitcoin is the biggest honeypot the world has ever seen; everyone and their grandma would love to break it. Further, the powers that be are, at least in part, powerful because of the fiat money printers that are rendered obsolete by the orange coin. Attacking Bitcoin becomes a necessary strategy if your very survival is threatened by it.

But, what parts of Bitcoin to attack? It is difficult to nail down what Bitcoin is and what it consists of in the first place. I like to think of it as a big hot mess of two parts software and two parts hardware—or wetware, to be more precise. A mix of technology and biology, with a large dash of economics on top.

Viewed in this light—that Bitcoin is made up of ideas, people, code, and nodes—it is easy to see that some attacks would be more obvious than others.

An obvious attack would be a software exploit that shuts down a large number of bitcoin nodes, for example. An even more obvious one would be a large-scale attack on its physical infrastructure. If the foundries that produce the current generation of SHA-256 ASIC chips are bombed or various large-scale mining operations go up in flames, we can confidently say that Bitcoin is under attack. In the same vein, if bitcoiners are declared the enemy of the state and are incarcerated or killed en masse, we can also deduce that Bitcoin is under attack.

But: how do you attack an idea? With bad ideas, that’s how. The civil war of the blocksize debate was such an attack on Bitcoin from the inside, and its resolution was a hard fork—an economic instantiation of said idea.

In addition to attacks from the inside, we already had many attacks from the outside. Almost as soon as Bitcoin appeared, it was attacked by politicians, central bankers, traditional investors wedded to the fiat system, as well as the economically and technically illiterate. We’ve heard it all before: bitcoin is only used by criminals, bitcoin is worthless, bitcoin’s value is based on pure speculation, bitcoin is old technology, bitcoin is too slow, bitcoin is a bubble, and so on and so forth.

Allow me to highlight some of the more recent terms and phrases dreamt up by those who hang on the tits of various money printers—whether it be politicians, special interest groups, or crypto bros.

“Unhosted Wallet”

Two words, one goal: pushing users away from sound money and independence into something that we all know too well from the fiat system: trust, and dependency.

The inconspicuous nature of this phrase is what makes this attack so ingenious. Calling a regular bitcoin wallet “unhosted” gives the impression that it should be “hosted” in the first place; that something is missing from how it should be, like an unfinished puzzle or an unsupported beam.

The discussion shouldn’t be about “hosting” in the first place. It should be about control. Who can access your funds? Who can freeze your account? Who is the master, and who is the slave?

Just like “the cloud is someone else’s computer,” a “hosted wallet” is someone else’s wallet. It should be obvious that the centralization of control is what brought about all the monetary problems in the first place, but I’m afraid that we will have to learn the lessons of history and the lessons of Mt. Gox over and over and over again: money held and controlled by others can and will be manipulated. We do not want to make this mistake again, which is why the following became a mantra of sorts: not your keys, not your bitcoin.

Bitcoin wallets are supposed to be unhosted—or, to use a word that wasn’t made up by devilish puppeteers: independent. The purpose of Bitcoin is to bring full sovereignty to the individual and to remove all dependencies on trusted third parties. No rulers, no masters, no hosts. Only peers.

Instead of using the term “unhosted wallet,” one could refer to regular bitcoin wallets as independent or freedom wallets. The opposite of an independent wallet is a custodial service, which means that you have a permission slip, nothing more. By using a custodial service, you destroy what makes bitcoin valuable in the first place. You revert to the permissioned model of money: a debt relationship between masters and slaves, which is the fiat system we want to move away from. Some have all the power; the users have none.

Such a custodial service, a service that they want you to refer to as a “hosted wallet”—but what might be better described as a slave wallet—offers nothing but IOUs: permission slips & debt certificates that can be revoked, multiplied, re-issued, and destroyed at any time. The slave has nothing; the master has everything.

Make no mistake: this is a war of narratives, and the stakes couldn’t be higher. Freedom vs. dependency, control vs. self-ownership, reliance vs. responsibility. If anything, a wallet should be self-hosted, and self-hosting is not a crime. However, we shouldn’t think of “hosts” in the first place. A wallet does not need to be hosted because a wallet, as we’ve seen previously, is nothing but a key—private information—combined with hardware or software that allows you to do something with said key, e.g., derive addresses or sign transactions.

Having 12 words in your head doesn’t make you the owner of an unhosted brain wallet; that’s ridiculous. You don’t need permission to remember 12 words by heart, and any law that makes the act of remembering 12 words illegal is a very, very, (very!) stupid law. But even ignoring this stupidity for a moment, such a law can’t possibly be enforced. It should be rendered meaningless as soon as it is passed. You can’t prove that I have 12 words in my head, just like I can’t prove that you are not thinking about an orange elephant at this very moment. Holding a key is knowing a secret, and here is the thing about secrets: if you don’t tell, nobody knows.

Letting someone else hold your keys destroys all the benefits that bitcoin brings with it. If others could be trusted with our money, we wouldn’t have needed Bitcoin in the first place. And if nobody takes the responsibility of self-custody, Bitcoin will be captured, just like gold before it.

Consequently, the term “unhosted wallet” is an attack on Bitcoin that we should take seriously, along with the implications that a successful ban would entail. It is a most ingenious and mischievous attack—subtle yet effective, re-framing what a wallet is and should be.

The fact that someone sat down and came up with this phrase makes me think that the powers that be are starting to grasp what Bitcoin is and how empowering it truly is, which is why they will do everything they can to keep you numb, dependent, and enslaved. “They want more for themselves and less for everybody else,” to quote George Carlin. “They don’t want well-informed, well-educated people capable of critical thinking.”2

Audio by George Carlin, from his 2005 special Life is Worth Losing

Ask yourself: should flipping a coin 256 times be illegal? What about math? What about having certain thoughts? Do we really want to live in a world in which having 12 words in your head makes you an outlaw?

#ChangeTheCode

Another phrase, another implication. The #ChangeTheCode campaign is ingenious; you have to give them that. It implies that Bitcoin’s code can’t be changed, which couldn’t be further from the truth.

Bitcoin is free3 and open-source software released under the MIT License.4 This means that anyone can change the code, Greenpeace or not, without having to ask for permission.

Allow me to replicate the license in full:

Permission is hereby granted, free of charge, to any person obtaining a copy of this software and associated documentation files (the "Software"), to deal in the Software without restriction, including without limitation the rights to use, copy, modify, merge, publish, distribute, sublicense, and/or sell copies of the Software, and to permit persons to whom the Software is furnished to do so, subject to the following conditions:

The above copyright notice and this permission notice shall be included in all copies or substantial portions of the Software.

THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM, OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

Anyone is and always was free to change the code of Bitcoin. Bitcoin’s free and open-source nature is why we have thousands of forks and clones in the first place, including forks that implement what the #ChangeTheCode campaigners are proposing.5

While this whole campaign to “change the code” shouldn’t be taken seriously in the first place, the tactics behind it shed some light on the attacker’s motivation and on what is yet to come. #ChangeTheCode was funded by Chris Larsen, founder of Ripple, the company that created the shitcoin that is XRP. These kinds of shitcoins can’t compete with Bitcoin on merit because they are permissioned, centralized, and have no reliable monetary policy, among other things. Consequently, they have to resort to smear campaigns and hiring reputational hitmen.

The thing about money is that all forms of money are competing, either directly or indirectly. All monies compete for liquidity, credibility, attention, value stored, and more. Consequently, the marketing departments of virtually all shitcoins are directing funds to dismiss or attack bitcoin in one way or another by implying that Bitcoin can’t be changed, that it is used for illicit activity, or that it is too slow or wasteful.

Bitcoin, however, is neither slow nor wasteful. Proof-of-work is insanely efficient if your goal is to create a monetary system that is free from politics and secured in a public and transparent manner. If you do not value such a system, it will always seem wasteful.

This, coincidentally, brings us to the next attack.

“Proof of Stake”

Let’s get one thing out of the way: there is no proof, there is no stake,6 and it isn’t even remotely comparable to its namesake, proof-of-work.

I have written extensively about proof-of-work in the past, so in the interest of not trying to repeat myself ad nauseam, I’ll try to be brief: proof-of-work solved the problem of telling time in a decentralized system, the problem of random selection, the problem of fair issuance, and the problem of unforgeable costliness in the digital realm. It embeds objective truth into a blob of data directly, which is why it is trustless and reliable. The information “speaks for itself,” to quote Satoshi.7

Proof-of-stake, on the other hand, has no objective truth, no objective time, no random selection, no fair issuance, no outside cost, no operational cost, and centralizes over time. It is the perpetual motion machine of consensus mechanisms, which is to say that it isn’t a consensus mechanism at all. It is rotten at its core because it relies on trust through and through.

Proof-of-stake should be called “just trust me, bro,” and therein lies the problem as well as the linguistic trickery: by calling it proof-of-stake, one might think that it is comparable to proof-of-work: “Ah, this one is just like the other one! Just another one of those consensus mechanisms, just as good as Bitcoin’s proof-of-work.” No. Wrong. Proof-of-stake is make-believe, and it will inevitably lead to all the ills that the make-believe world of the fiat monetary system suffers from, as the various failures of these systems show time and time again.8

Conclusion

Words have meanings, which is why we should choose them wisely and carefully. Bitcoin is not wasteful.9 Bitcoin is not closed source.4 Bitcoin is not controlled by shadowy supercoders.10 Bitcoin is not war. An ASIC is not a gun. If anything, Bitcoin is a Wittgensteinian language-game,11 using words and chance for peaceful conflict resolution.

Allocation follows perception, as does public policy. Perception, in turn, is shaped by our understanding and the very words we use to arrive at and describe said understanding.

In a world awash in euphemisms and blatant lies, calling something by its proper name is rebellious in itself. Bitcoin is about freedom and self-sovereignty, not about asking for permission. It is about independence and verifiable truth; extreme ownership and responsibility; hope12 and human rights.13

The best way to fight bad ideas and bad terminology is with good ideas and good terminology. Thus, we should all make an effort to call things by their proper names, try to understand their inner workings, and explain them in simple terms to others.

Bitcoin isn’t as complicated as it might seem at first. It is just very alien, which is why all metaphors we use to describe it break down at some point. As we have seen, wallets, keys, addresses, coins, and many other words we use are insufficient to truly explain what is going on.

The confusion which inevitably arises out of this misunderstanding is used and abused by Bitcoin’s detractors, be it from the church of “fiat” or the cult of “crypto.”14

Obviously, “honeybadger don’t care” when it comes to most of these attacks. Bitcoin will march on regardless, but that doesn’t mean that we should give in to the various narratives and framings that are set up by those who want to control and oppress (or those who want to make a quick buck). Bitcoin is made of people, and it is individual people that will suffer—either from short-sighted regulations, economic repercussions, poisonous snake oil, or rug-pull-induced concussions.

Bitcoin is a return to sanity, one that is desperately needed in the insane world of QE infinity and negative interest rates. The tragicomedy of our current financial system reads like the introduction to a game show: “Whose deficit is it anyway? An economy where everything is made up and the points don’t matter.”

The points in Bitcoin do matter, as do the words that we use to describe it. Bitcoin is truthful and precise in its speech, and we should strive to be too.

M. Goldstein (2014). Everyone’s a Scammer ↩

“The politicians are put there to give you the idea that you have freedom of choice. You don’t. You have no choice. You have owners. They own you. They own everything. They own all the important land. They own and control the corporations. They’ve long since bought and paid for the Senate, the Congress, the state houses, the city halls. They got the judges in their back pockets and they own all the big media companies, so they control just about all of the news and information you get to hear. They got you by the balls. They spend billions of dollars every year lobbying. Lobbying to get what they want. Well, we know what they want. They want more for themselves and less for everybody else, but I’ll tell you what they don’t want. They don’t want a population of citizens capable of critical thinking. They don’t want well-informed, well-educated people capable of critical thinking. They’re not interested in that. That doesn’t help them. That’s against their interests.” —George Carlin ↩

What is Free Software? by the Free Software Foundation ↩

Bitcoin is and always was free and open-source software. It is released under the MIT License. “Being open source means anyone can independently review the code. If it was closed source, nobody could verify the security. I think it’s essential for a program of this nature to be open source.” —Satoshi Nakamoto (2009) ↩ ↩2

Three historical forks that implement what #ChangeTheCode is advocating for are “Bitcoin Oil,” “Bitcoin Stake,” and “Bitcoin Interest.” See this BitcoinTalk discussion from 2018. ↩

Proof-of-stake suffers from the “nothing at stake” problem. “You don’t lose anything from behaving badly, you lose nothing by signing each and every fork, your incentive is to sign everywhere because it doesn’t cost you anything.” ↩

“Proof-of-work has the nice property that it can be relayed through untrusted middlemen. We don’t have to worry about a chain of custody of communication. It doesn’t matter who tells you a longest chain, the proof-of-work speaks for itself.” —Satoshi Nakamoto (2010) ↩

See dergigi.com/pos to understand why proof-of-stake is and always will be a defective consensus mechanism. ↩

Parker Lewis (2019). Bitcoin Does Not Waste Energy ↩

Jonathan Bier (2021). The Blocksize War ↩

Allen Farrington (2020). Wittgenstein’s Money ↩

Alex Gladstein (2022), Check Your Financial Privilege. See also this compilation of videos from the Oslo Freedom Forum 2022. ↩

One should note that “crypto” is yet another linguistic attack on Bitcoin, making it seem like there are many other projects that are either interesting, viable, or comparable. This couldn’t be further from the truth. Virtually all of “crypto” is a scam. The word “crypto” also leaves out the other half of what makes Bitcoin work, namely the “econ” part. After all, Bitcoin is a cryptoeconomic system. ↩

Conversations

- 2022-07-02 Bitcoin Rapid Fire

on Truth, Love, and Bitcoin, hosted by John Vallis - 2022-05-18 Stephan Livera Podcast #379

on Linguistic Attacks on Bitcoin, hosted by Stephan Livera

Translations

- German audio by Bibliothekar

- Spanish translation by Cyber Hornet

- English audio by Guy Swann

- Italian translation by Milano Trustless

- Greek translation by Nina

- Slovenian translation by Peter Golob

- German translation by Simon Satoshi

- Dutch translation by Sovereign Monk

- French translation by Sovereign Monk

Want to help? Add a translation!

🧡

Found this valuable? Don't have sats to spare? Consider sharing it, translating it, or remixing it.Confused? Learn more about the V4V concept.