I am writing this letter because I am convinced of two things: (1) our current money is fundamentally broken (2) using superior money will benefit you in particular — and society in general — in the long run.

Money is a touchy subject — most people don’t like to talk about it, either because they have little and are ashamed, or because they have lots and are afraid. Even fewer people know anything about the nature of our money, which is quite shocking — after all, money is an essential tool of our civilization.

The world has changed drastically in the last couple of decades, as has the world of money. I’m afraid, however, that the underlying nature of our monetary system has not changed for the better. The simple fact that governments around the world are conjuring up trillions (with a T) of dollars out of thin air is a testament to how disconnected our monetary system is from reality.

I hope that this letter will plant the seeds for a better future. A better future for you, personally — and a better future for us all. In part, I am writing to you because I’m worried about what is yet to come. And yet I am hopeful, because this time, we have a way out — we have a Plan B.

Plan B

By now, you have probably heard about Bitcoin. It is a household name, frequently featured in major news outlets, on TV (I’m looking at you, CNBC), and referenced in pop-culture (The Simpsons, Mr. Robot, Silicon Valley, The Big Bang Theory, Grey’s Anatomy, Family Guy, and The Simpsons again). Whatever you might know or think you know about Bitcoin — there is more to it than meets the eye.

While Bitcoin has been covered in the mainstream media quite a bit, what Bitcoin is and what its role in the world will be is still widely misunderstood. However, in part thanks to more and more reckless monetary interventions by the Fed and similar institutions, even the mainstream narrative is beginning to shift. Bitcoin is not a synonym for criminality and darknet money anymore. Today, it is more and more becoming a synonym for sound money, a hedge against the current system, a vote for freedom, a different paradigm.

If you are reading this and still have no bitcoin you might want to think about starting to get some. It was never as easy as it is today to get your hands on some sats (tiny fractions of a bitcoin) and become an early adopter of the global money of the future.

Be warned: I will not tell you how Bitcoin works. I will not tell you about its captivating history, or its mysterious inventor, or about the marvelous design, cryptography, and game theory behind it. I will not talk about economic theories, or monetary properties, or the history of money. There are plenty of resources that go into that. After all, this is supposed to be a letter, not a book.

However, since I care about you, I will tell you one thing, over and over again: start stacking sats, as soon as you can.

Start Stacking Sats, Today

You might think that you’re late to the party, that the ship has sailed. Wrong. You’re still early. Bitcoin will continue to march on, growing in size and value, eating up the government-controlled fiat currencies that rule the world today. How do I know that these are still early days? Well, while most people have heard about Bitcoin by now, very few people own or use it. Further, if we compare the market capitalization of Bitcoin to other assets and/or monies, Bitcoin still has tremendous room for growth.

As of this writing, Bitcoin’s market cap is around $137 billion. The total market cap of gold is around $9 trillion (~65 times larger than Bitcoin). That of real estate, globally, is $228 trillion (~1664 times larger). Bitcoin may capture some (in the case of real estate) or all (in the case of gold) of this value, demonetizing these and other assets in the process. Again: these are still early days.

We are in the process of repricing the world in sats.

Granted, buying and holding bitcoin is nuanced. It is easy to shoot yourself in the foot. It is easy to get scammed. It is possible to lose access to your bitcoin for good. Thus, a word of warning: educate yourself, and err on the side of caution.

Unfortunately, I didn’t have a “Bitcoin Guy” who understood what was going on. I didn’t have this one friend who told me “trust me, just buy some bitcoin” — or, even better: “trust me, just buy a little regularly.”

So I would like to be this Bitcoin Guy now, for you. Here is what I would say to you, as a friend: “start stacking sats, today.” If you already do, good. If you don’t, start stacking. It’s not that difficult!

Why Bitcoin is Necessary

We, as a society, need Bitcoin more than it needs us. Money is an essential tool for any large-scale cooperation. It is a measuring device, a solution to the problem of barter, a vehicle to store your wealth over space and time, and many other things. In short: money is essential for a complex society to function. However, a series of financial crises and recent events around a certain virus outbreak have clearly shown that our money is fundamentally broken.

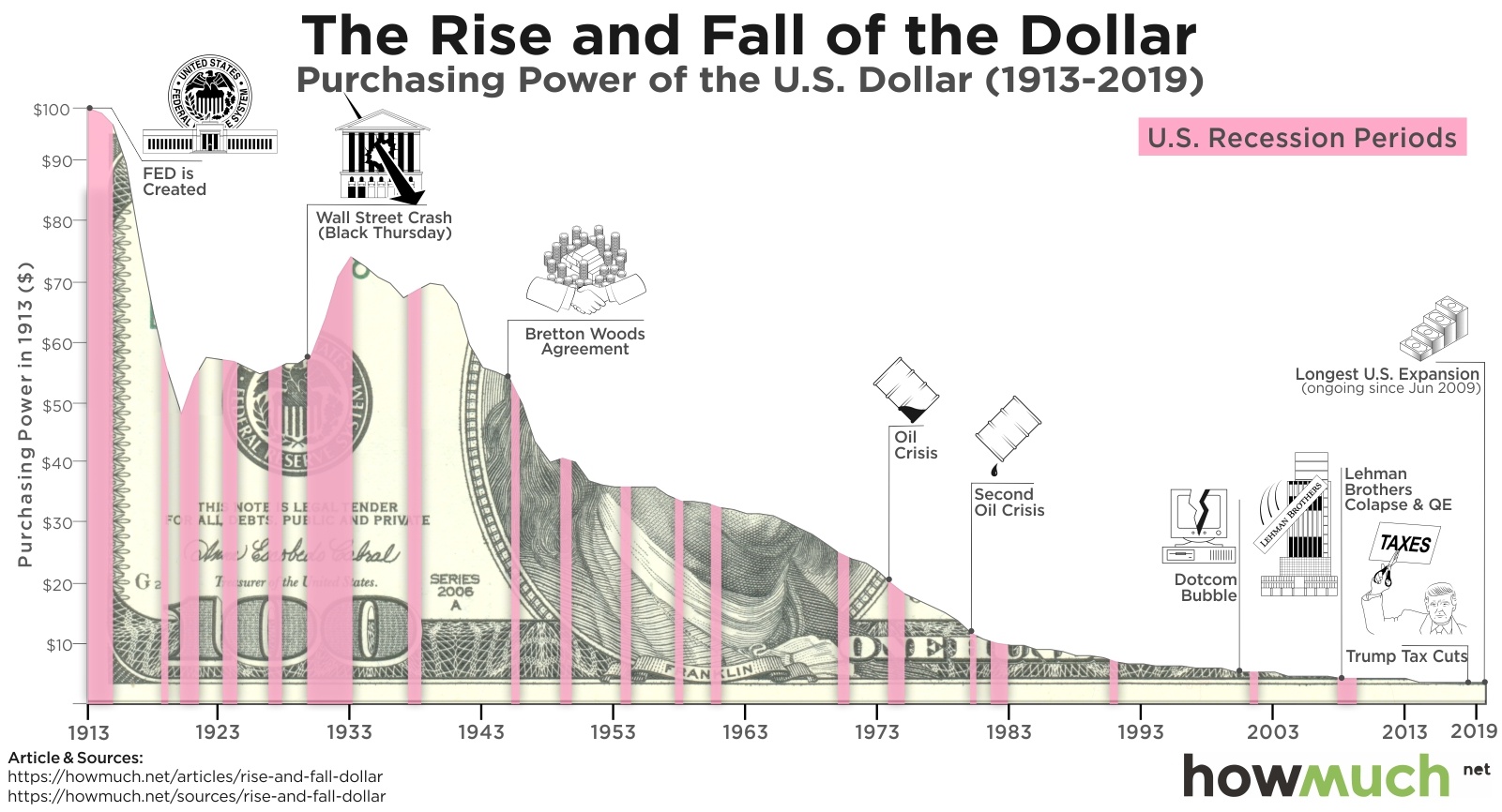

The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.

The virus not only reminded us of the fragility of human life, but it also revealed the fragility of our supply chains and other global systems. In particular, it highlighted the ridiculousness of our financial and monetary system. In a matter of days, we went from printing billions to trillions, to proposals of minting trillion-dollar-denominated platinum coins, to unlimited QE and infinite cash. Economists and politicians speak of saving the economy, of injecting liquidity, of quantitative easing, of reverse repurchase agreements, of bailing out those who are too big to fail (again) — of doing everything in their power to prolong the inevitable collapse, to kick the proverbial can even further down the road.

While the lingo is fancy, the repercussions are simple: an essential tool of our civilization is bent and distorted. Hyperinflation is what happens when this tool finally breaks under constant pressure. Hyperinflation or not, the repercussions for the individual are always the same: the money you save gets devalued, its purchasing power diminished. Whether your money is sitting under your mattress or in your bank account doesn’t even matter.

The world has gone mad and the system is broken.

As Ray Dalio explains so eloquently: our debt-based system of money is inherently broken. Bitcoin fixes this. It fixes this because it is not based on debt. It fixes this because it has a strictly limited supply. It fixes this because it can’t be created arbitrarily; because there are no gatekeepers, no central powers that might corrupt it.

Bitcoin is the antidote to modern monetary theory. It is necessary to straighten out the crooked world of fiat money.

The Best Money We Ever Had

Bitcoin’s monetary properties are designed from the ground up to be superior to all other forms of money. It is extremely portable, perfectly scarce, highly divisible, easily verifiable, durable, fungible, and extraordinarily resistant to censorship. As a friend of mine likes to say: Bitcoin is pieces of super-gold flying inside an unstoppable PayPal. It is the best money we ever had.

No central authority bestows these properties upon bitcoin. They emerge naturally from within the system, a fact that is as beautiful as it is important. Thus, Bitcoin is the people’s money: for the people, by the people. Not controlled by anyone; auditable and useable by everyone.

Buy land. They ain’t making any more of the stuff.

Will Rogers had the right idea: scarcity has value. However, as a store of value, Bitcoin is superior to land (and gold, for that matter) in many ways. No other asset can be magically beamed across the internet or other communication channels. Bitcoin has the highest value density of all assets since it is pure information. You could have a billion dollars worth of bitcoin in your head, retaining your wealth even if stripped naked.

While there are many misconceptions about Bitcoin, the following are probably the most prominent:

- Bitcoin is too expensive

- Bitcoin is old technology

- Bitcoin is too complicated

- Bitcoin is risky and speculative

- Bitcoin will be replaced by another coin

Let’s briefly go through these one-by-one.

Bitcoin is too expensive: To the contrary! Don’t let the “I need a whole coin” unit bias fool you. Bitcoin is still very cheap. However, if you think that way, you’re in good company. People have been thinking that bitcoin is too expensive since its inception. It will always be too expensive if your perspective is still rooted in fiat money.

Bitcoin is old technology: First of all, Bitcoin is a monetary invention rather than a technological one. It aims to replace the monetary base layer of our society — it isn’t the next viral app for your smartphone. Second of all, Bitcoin is improving and evolving at a rapid pace. It’s virtually impossible to keep up with all developments across the board.

Bitcoin is too complicated: Granted, Bitcoin isn’t exactly easy to understand. (But neither is the traditional financial system.) Luckily, as with all other complex technologies, usage doesn’t require complete understanding. If it would, you probably couldn’t use your smartphone, use the internet, or drive your car. And in terms of usage, Bitcoin becomes easier every day. Just like using the internet a couple of decades ago wasn’t exactly easy, using Bitcoin today can be challenging at times.

Bitcoin is risky and speculative: Don’t speculate. Stay humble and start stacking sats. If that’s not good enough for you, how about the fact that a portfolio of 5% bitcoin and 95% cash outperformed stocks on risk and returns every year for the past 6 years? Still too risky?

Bitcoin will be replaced by another coin: Bitcoin is the undisputed king and the only serious contender for digital scarcity. It has the best network effects, the highest liquidity, and the highest security by many orders of magnitude. Nothing else comes close, and I don’t want to waste any digital ink naming any other coin. All I will say about Bitcoin’s copy-cats is this: do not touch them. While the Siren’s song of shitcoins is hard to resist, they are called shitcoins for a reason. Bitcoin can’t be copied. It is a path-dependent-invention in a winner-takes-all environment.

There is bitcoin, and then there is shitcoin.

Shitcoins are a dead end. Don’t go down this path. Nothing but pain and sorrow will await you there.

Why Stacking Sats Is Superior

As of this writing, $1 will buy you 14,488 sats. Spend $70, and you are a satoshi millionaire. Bitcoin is expensive. Sats are cheap.

As mentioned above, bitcoin is highly divisible. Again, don’t let any unit bias fool you: there is enough bitcoin to go around for everyone. Trying to buy large sums of bitcoin usually leads to trying to time the market. Stacking sats removes this psychological pressure. Even better: plenty of services exist which let you automate the process of stacking sats. Set it and forget it, and your stack will grow automatically. No need to worry about the perfect timing, no frantic checking of price, no exposure to custodians.

We all know the old proverb: “The best time to plant a tree was 20 years ago. The second best time is now.” The same is true for stacking sats — only Bitcoin didn’t exist 20 years ago. It is now a bit over 11 years old, bursting into global consciousness just a couple of years ago.

The best time to buy bitcoin was 10 years ago. The second best time is now.

The point is this: don’t beat yourself up having a 0% allocation to bitcoin. It’s not too late to get off zero. Again: it’s not too late. You are still early. Currently, you are still able to exchange other money for bitcoin. In the future, you will probably have to earn it. Think of it this way: if the trajectory that Bitcoin is on continues, there will never be a bad time to exchange your fiat currency for bitcoin.

Bitcoin is a game of accumulation. Once you realize that, stacking sats becomes the obvious strategy. Inelastic supply and the relatively small market capitalization make bitcoin more volatile than other assets. (Although, compared to recent movements in the traditional markets, bitcoin is relatively stable.) Stacking sats enables you to ignore the volatility of the market. The focus is on passive accumulation, not trading.

Bitcoin is a new type of money that is digital and independent of world governments or corporations. It is hard to seize, block, or inflate and easy to send around the world. It is the best money we have ever had. As more people realize this, the price should rise.

Zoom out far enough and it becomes obvious that the price movement of Bitcoin is up and to the right. There are reasons to believe that this trend will continue. Even with this upward trend intact, the price of bitcoin will probably remain volatile for quite a while. My advice: ignore the price. Get off zero. Do you still have zero sats to your name? Stop slacking — start stacking!

Some things to remember:

- Don’t trade

- Get off zero

- Automate with Auto-DCA

- Everyone thinks they are late

- You can buy a fraction of a bitcoin

- Trusted third parties are security holes

- Time in the market beats timing the market

- There is gold and there is fool’s gold — stay away from shitcoins

You might think that you don’t have enough money to start stacking sats. I doubt it. If you are reading this, you are probably on level 4 and able to spare a dollar or two per day. Remember: a couple of dollars will buy you tens of thousands of sats. There are also indirect ways to stack sats, such as cashback services that pay you back in sats. You can also kick a bad habit and start stacking sats with the money you save. Two birds with one stone, and all that.

Sats are still stupidly cheap. I’d bet that there will soon come a time where it won’t be possible to acquire tens of thousands of sats for $1. The purchasing power of the dollar is going down continually; the purchasing power of bitcoin has been going up, historically. However, even if the price of bitcoin keeps rising drastically, you will probably still be able to get your hands on a couple of sats for $1 or less for the foreseeable future.

You’re skeptical, I get it. I was skeptical too. It took me a very long time to understand what Bitcoin is about. It took me even longer to trust this magic internet money enough to buy some. And after that, it took me a while to stop trading and start accumulating. I hope to save you some time and a lot of heartaches by passing on the following: start stacking sats. The earlier you start, and the more automated the process, the better.

All that being said, a word of caution:

- Start small. Don’t put in more money than you are willing to lose.

- Stay humble. Don’t get greedy. Don’t over-extend yourself.

- Not your keys, not your bitcoin. Do not trust custodians. Always remember that trusted third parties are security holes.

- Don’t trust, verify. Assume that everyone is a scammer.

- Do your own research. Bitcoin is open by nature, so you are free to study what it is and how it works. I curate a comprehensive list of resources if you need a starting point.

There was never a better time to start saving in bitcoin. Many services exist which let you automatically convert a certain amount of your local currency into bitcoin every week, month, or day. I will refrain from any recommendations here since they might be outdated soon. What the best service is for you is yours to find out. Contact your local friar or the bitcoin guy closest to you. If he doesn’t know what stacking sats means, find a better bitcoin guy. (And if I happen to be that guy, please reach out to me.)

Owning bitcoins is one of the few asymmetric bets that people across the entire world can participate in.

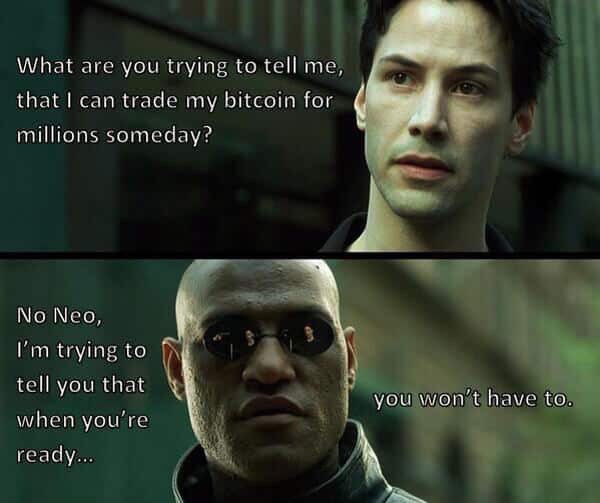

While Bitcoin is an investment in the future, I don’t necessarily view it as a speculative investment. I also do not view it as an asset that is to be sold again for dollars, euro, or yen. As the meme goes: When you’re ready, you won’t have to sell your bitcoin.

Ready When You Are

Exchanging your fiat money for bitcoin is a move from an inherently unstable system to an anti-fragile one. It is wealth insurance and a vote for a better, more honest base layer of society. I believe that bitcoin still has a very high potential upside. Thus, the sooner you start to get exposure to this emerging money the better equipped you might be to benefit from its rising purchasing power. In other words: you want to start stacking sats as soon as you can. However, I also believe that Bitcoin will be understood by you as soon as you are ready. Consequently, I believe that the first fractions of a bitcoin will find you as soon as you are ready to receive them. “You can lead a horse to water, but you can’t make it drink,” as the saying goes.

You will find that owning bitcoin requires personal responsibility: you will have to do your own research, learn how to use and store it securely, and do many things yourself that are usually done for you by a third party. Nothing in life is free, and the freedoms granted by Bitcoin come at the price of personal responsibility.

In any case, Bitcoin is ready when you are. It won’t go away, and nobody will be able to stop you from acquiring some if you are ready to do so. That’s the beauty of Bitcoin: it will always be there for you, whether you make use of it or not.

Granted, Bitcoin is a strange beast. It is complicated, overwhelming, maybe even a bit scary. However, the sooner you befriend this strange creature, the better you will be equipped for the future. And I believe that the best way to befriend it is to start stacking sats. As a wise old man once said: “Just buy bitcoin, it’s not that difficult.”

Disclaimer: This should go without saying, but I’m afraid I’ll have to make it explicit: This is not financial advice. This is not investment advice. I wrote this letter to have something at hand whenever friends or family reach out to me in all matters bitcoin. I published it because I thought others might find it useful as well. If you don’t know me in real life I’m just a random guy from the internet. I might as well be a dog. Act accordingly.

Get started

- Setting Up Your First Bitcoin Mobile Wallet

- 12-Step Intro to Start Using Bitcoin

- Getting started with Bitcoin

Further Reading

- The Bullish Case For Bitcoin by Vijay Boyapati

- Gradually, Then Suddenly series by Parker Lewis

Further Listening

- Explaining Bitcoin to Traditional Investors by John Vallis

- The Beginner’s Guide to Bitcoin by Peter McCormack

Further Resources

Acknowledgments

- Thanks to Brekkie and Fab for their valuable feedback on earlier drafts of this letter.

- Thanks to Hass for proofreading and his willingness to die on the AutoDCA hill.

Translations

- Arabic translation by Ahmad Hamdan

- Persian translation by Ali Arianfar

- Brazilian Portuguese audio by Bitcoin Brasil

- French translation by Bitcoin Frenched

- Danish translation by BitcoinInfo DK

- Dutch translation by Bram

- Indonesian translation by Dea Rezkitha

- German translation by Fab The Fox & ge3onim0

- Japanese translation by Fuuuumin

- English audio by Guy Swann

- Turkish translation by Kemal

- Lithuanian translation by Laura Simukauskaite

- Italian translation by Luca Sonzogni

- Spanish audio by Marcelo

- Spanish translation by Nicolás

- Greek translation by Nina

- Finnish audio by Oispa Pitkoo

- Brazilian Portuguese translation by Pensaduras

- Slovenian translation by Peter Golob

- Swedish translation by Pleb Joker

- Finnish translation by Rahaton Nainen

- Norwegian translation by Sebbikul

- Portuguese translation by Sparkpay

- Romanian translation by Thursday

- Serbian translation by Tink

- English audio by Walker America

- Chinese translation by 比特幣中文選讀

Want to help? Add a translation!

🧡

Found this valuable? Don't have sats to spare? Consider sharing it, translating it, or remixing it.Confused? Learn more about the V4V concept.